All Categories

Featured

Table of Contents

The remainder of their industrial actual estate bargains are for recognized capitalists just. VNQ by Lead is one of the largest and well understood REITs.

Their leading holding is the Vanguard Property II Index Fund, which is itself a mutual fund that holds a variety of REITs. There are other REITs like O and OHI which I am a long-time investor of. REITs are an easy way to acquire actual estate direct exposure, but it does not have the same amount of focus as eREITs and specific business property deals.

To be an certified investor, you need to have $200,000 in yearly revenue ($300,000 for joint financiers) for the last 2 years with the expectation that you'll make the very same or a lot more this year. You can likewise be taken into consideration an accredited capitalist if you have a web worth over $1,000,000, independently or jointly, excluding their key home.

How do I exit my Accredited Investor Rental Property Investments investment?

These offers are commonly called exclusive placements and they don't require to sign up with the SEC, so they do not offer as much details as you would certainly anticipate from, claim, a publicly traded company. The certified financier need thinks that a person who is accredited can do the due diligence on their own.

You simply self-accredit based upon your word. The SEC has also expanded the meaning of accredited financier, making it easier for even more people to qualify. I'm bullish on the heartland of America provide then reduced assessments and a lot higher cap prices. I think there will be continued movement far from high expense of living cities to the heartland cities due to cost and modern technology.

It's everything about following the cash. In enhancement to Fundrise, likewise take a look at CrowdStreet if you are an accredited financier. CrowdStreet is my favored platform for certified investors since they focus on arising 18-hour cities with reduced evaluations and faster populace growth. Both are free to authorize up and check out.

Below is my real estate crowdfunding control panel. If you intend to find out more about realty crowdfunding, you can visit my realty crowdfunding finding out facility. Sam worked in spending banking for 13 years. He obtained his undergraduate level in Business economics from The University of William & Mary and obtained his MBA from UC Berkeley.

He spends time playing tennis and caring for his family members. Financial Samurai was started in 2009 and is one of the most relied on personal money sites on the internet with over 1.5 million pageviews a month.

With the U.S. actual estate market on the surge, investors are sorting with every readily available building kind to find which will help them revenue. Which sectors and homes are the ideal relocations for financiers today?

Can I apply for Accredited Investor Real Estate Investment Groups as an accredited investor?

Each of these types will certainly feature distinct advantages and drawbacks that financiers need to evaluate. Let's look at each of the alternatives offered: Residential Property Commercial Real Estate Raw Land & New Building And Construction Realty Investment Company (REITs) Crowdfunding Platforms Register to participate in a FREE on the internet actual estate class and find out just how to begin buying realty.

Other houses include duplexes, multifamily properties, and getaway homes. Residential realty is perfect for numerous capitalists because it can be easier to transform profits regularly. Certainly, there are lots of residential real estate investing methods to deploy and various levels of competition throughout markets what might be best for one investor may not be best for the following.

What should I look for in a Accredited Investor Rental Property Investments opportunity?

The ideal industrial homes to buy include commercial, office, retail, friendliness, and multifamily projects. For capitalists with a strong focus on enhancing their neighborhood communities, industrial realty investing can support that focus (Real Estate Investment Funds for Accredited Investors). One factor industrial residential or commercial properties are thought about among the most effective kinds of realty financial investments is the capacity for greater money flow

To read more concerning beginning in , make certain to review this write-up. Raw land investing and new building stand for 2 sorts of property financial investments that can branch out an investor's profile. Raw land describes any uninhabited land readily available for acquisition and is most eye-catching in markets with high predicted growth.

Buying brand-new construction is additionally preferred in swiftly growing markets. While many capitalists may be not familiar with raw land and new construction investing, these investment kinds can stand for attractive profits for capitalists. Whether you want creating a residential property from beginning to end or making money from a long-lasting buy and hold, raw land and brand-new building give a distinct possibility to investor.

How long does a typical Commercial Property Investments For Accredited Investors investment last?

This will certainly guarantee you pick a desirable area and protect against the financial investment from being hindered by market factors. Property investment company or REITs are firms that own various industrial real estate types, such as resorts, shops, workplaces, shopping centers, or restaurants. You can invest in shares of these property firms on the stock exchange.

It is a requirement for REITs to return 90% of their gross income to shareholders annually. This uses investors to get rewards while diversifying their profile at the same time. Publicly traded REITs also provide flexible liquidity in contrast to other kinds of property financial investments. You can market your shares of the company on the stock market when you need reserve.

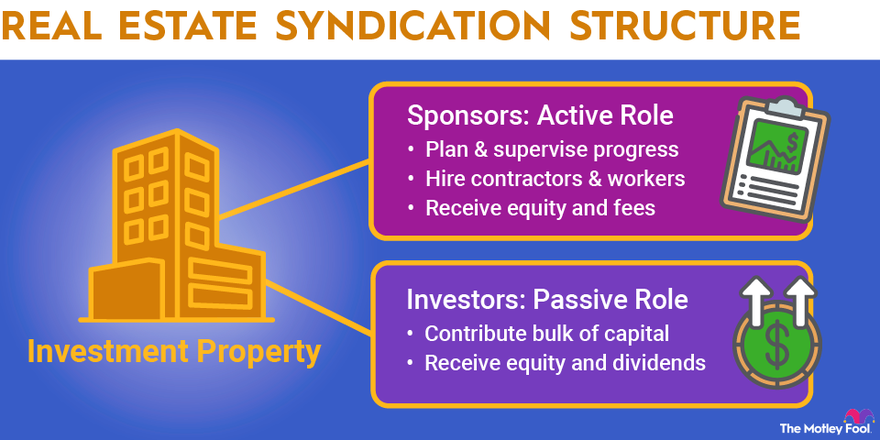

While this provides the ease of discovering assets to capitalists, this kind of genuine estate financial investment also presents a high quantity of threat. Crowdfunding platforms are normally restricted to certified financiers or those with a high internet worth.

What is the process for investing in Real Estate Investment Partnerships For Accredited Investors?

The best kind of actual estate investment will certainly depend on your individual scenarios, goals, market location, and favored investing technique - High-Yield Real Estate Investments for Accredited Investors.

Picking the right property kind boils down to weighing each option's advantages and disadvantages, though there are a few essential elements capitalists need to remember as they seek the most effective choice. When picking the most effective kind of financial investment property, the importance of place can not be underrated. Investors operating in "promising" markets may find success with uninhabited land or brand-new construction, while capitalists operating in more "mature" markets might have an interest in homes.

Evaluate your favored level of participation, danger resistance, and earnings as you decide which home type to buy. Investors desiring to tackle an extra passive function may choose buy and hold commercial or houses and utilize a home manager. Those hoping to tackle an extra energetic role, on the various other hand, may locate establishing uninhabited land or rehabbing residential homes to be more meeting.

Table of Contents

Latest Posts

Government Tax Foreclosure Auction

Delinquent Tax Auction

Outstanding Tax Liens

More

Latest Posts

Government Tax Foreclosure Auction

Delinquent Tax Auction

Outstanding Tax Liens